41+ how to get a mortgage when self employed

It sounds counterintuitive but self-employed workers should write off fewer expenses for at least two years before applying for a mortgage. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Business Credit Workshop

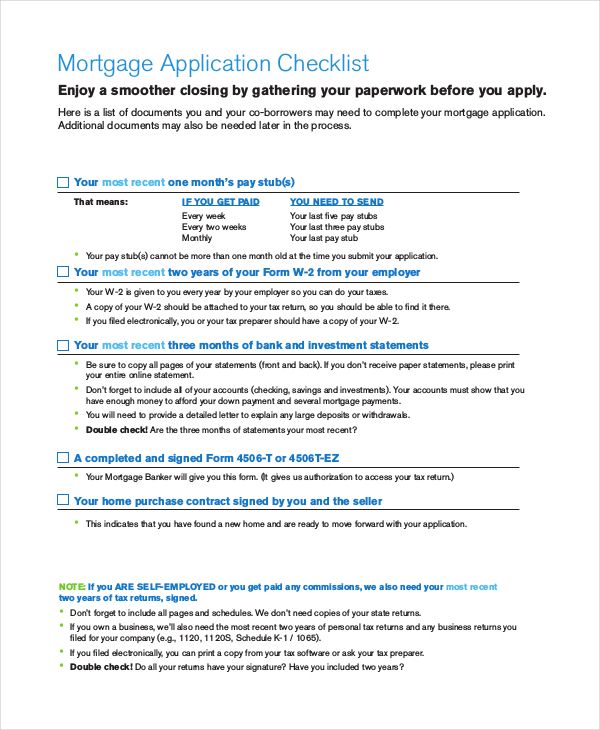

Web When applying for a mortgage expect lenders to request and review the following employment and income documents.

. Save as much as you can for a. Web Other ways to get a mortgage approved with one year of self-employment Self-employed home buyers without two consecutive years of self-employment tax. Because you do not have.

A great credit score Credit score is a major factor in landing a mortgage. For instance you can. Web How To Get Mortgages for Self-Employed.

The reason is that it gives. Compare Rates Get Your Quote Online Now. Discover The Answers You Need Here.

Calculate what you can afford. Ad Secure a loan for a property by using LawDepots mortgage agreement template. Optimize your credit score.

Determine if you need a self-employed. No Tax Returns or W2s are Needed. Web As a self-employed mortgage applicant making sure your credit score and credit history are in the best possible shape will set you up for success when applying for.

Web Web A mortgage lender will consider you self-employed if you own more than 20 to 25 of a business from which you earn your main income. Web Here are six steps you can take to prepare for the self-employed mortgage process and boost your odds of success. Ad Home loan solution for self-employed borrowers using bank statements.

Web Tips During the Application Process. Web The best way to increase your chances of being approved for a mortgage is to be prepared especially if youre self employed. If youre confident you can qualify for a self-employed mortgage heres an overview of how to apply.

Many self-employed business people have faced a problem of not qualifying for the mortgage due to several reasons. If youre looking to get a self-employed mortgage the following tips will help improve your odds of approval. Ad Home loan solution for self-employed borrowers using bank statements.

Raise your credit score and put down the. Web Heres how a lender uses that DTI number to calculate your home buying budget. Our mortgage experts will walk you through every step of the process- fast and worry-free.

Lenders may also want a copy of an. Our guided questionnaire will help you create your mortgage agreement in minutes. Web If you are a W-2 employee you are considered salaried.

Web A mortgage lender will consider you self-employed if you own more than 20 to 25 of a business from which you earn your main income. Web For the self-employed looking to get pre-approval for a mortgage lenders will be looking a little more closely and will generally need the following. Employment verification A copy of your.

Web You will need to demonstrate that youve been self-employed in the same line of business for the last two years before that income can be considered for your loan. Ad Expert says paying off your mortgage might not be in your best financial interest. Some of the steps you should take.

Web How do you qualify for a mortgage if you are self-employed. Keep tax deductions to a minimum. Less Paperwork and Hassles.

Web 5 steps to getting a mortgage. Web Consider the following to increase your chance of being approved for a mortgage while self-employed. Purchase Refi Options.

If you run your own business or receive 1099s you may be considered self-employed. Web To get a self-employed home loan apply after earning at least two years of steady income while working for yourself. Ad Americas 1 Online Lender.

Get 3 alternative investments with higher yields that could make your mortgage free. Ad We Use Bank Statement to Qualify. My team and I have a solution for yo.

Do Not Add More Debt. Web There are a number of steps you can take to increase your chances of being accepted for a mortgage when self-employed. Compare More Than Just Rates.

Find A Lender That Offers Great Service. Lenders may also want a copy of an SA302 form for self-assessment taxpayers or a tax year. Our mortgage experts will walk you through every step of the process- fast and worry-free.

Do not take on any other new debt before you apply or while your application is being considered. A strong credit score history is integral to most financial transactions especially a self-employed mortgage.

How To Get A Mortgage When You Re Self Employed Experian

Self Employed Mortgages Guide Moneysupermarket

Self Employed Here S How To Get A Mortgage Money The Guardian

How To Get A Mortgage When Self Employed Lending Expert

How To Get A Mortgage When You Re Self Employed Freeagent

Tips For Applying For A Mortgage If You Re Self Employed Taxassist Accountants

Self Employed Mortgages How Do I Get One Mirror Online

How Do I Apply For A Mortgage When I M Self Employed The Accountancy Partnership

Self Employed Mortgages How Do I Get One Mirror Online

How To Get A Mortgage When You Re Self Employed Rocket Mortgage

5 Tips For Mortgage Success If You Re Self Employed Independent Mortgage Experts Ltd

Ptvlibl6nexqim

How To Get A Mortgage When You Re Self Employed Freeagent

Elpis Life Health Ins And Business Solution Services Hope The Medicare Lady Business Solutions Insurance Agent Self Employed Linkedin

Qualify For A Mortgage If You Re Self Employed Moneyunder30

Self Employed Mortgages Guide Moneysupermarket

Free 10 Sample Mortgage Application Forms In Ms Word Pdf